1. Take advantage of financial education and tools

There is actually no need to get stressed up to figure out your financial life on your own, there are abundant ways to get help from. Do you know that a lot of financial companies including banks and brokerages provide offer free online tools and education? Even financial advisors can help with everything such as, from creating a financial plan to ongoing investment management.

2. Do the most important thing first

You must have noticed that as the day goes on you will have more confusion and can get many thoughts related to the work. It can happen that whatever decision you have made previously tends to drain your willpower as the day passes. So it is very necessary and smart work to complete the work which is very much important to you. Following this simple strategy will make sure that you will never have a single day when you feel that you have not completed your work. You will have a productive day, even if everything does not go as per the plan.

3. Recognize and Manage Lifestyle Expansion

The more money you have tend to spend that much more money. Even if you can pay all the bills or purchase whatever you want, lifestyle expansion can be damaging in the long run or in the future because it definitely limits your ability to build wealth. The unnecessary extra dollar you are spending now means less money later. As you will enter into different phases of life recheck or replan your personal budget so that it can reflect the right conditions in your life. If you are preparing a list of expenses, make sure and understand which thing is truly needed and which you can go without.

4. Make Personal Budgets

Everyone says that money comes in, and money goes out. That doesn’t mean that you will not keep track of money or not have any budget. It is about as deep as their understanding gets when it comes to personal finances. Rather than ignoring your finances a bit of counting can help you estimate your current financial health. It will also help you to achieve your short- and long-term financial goals. You should know that a personal budget is an important financial tool because due to it you will know and understand future costs, you can save for future goals, and reduce unnecessary spending.

5. Recognize Needs vs Wants

You should understand firstly the difference between need and want, as there is a thin line between these two. Needs are things you have to have to survive. shelter, food, clothing healthcare are some examples of needs. Wants are things that you would like to have but they are not that necessary or don’t require for survival. One should always keep the needs on top priority. And when the needs have been fulfilled, after checking the budget one can spend some money on what they want.

6. Organize your bank accounts

Organizing your bank accounts is also a major part of improving your wealth management. One can use a debit card or cash to keep the money organized. Never forget to check and save accounts set up with a bank you trust the most. The most simple way to improve your financial health is to get your accounts organized for automatic saving or direct deposit.

7. Build and Maintain an Emergency Fund

An emergency fund is a money that has been kept aside for emergency purposes. This fund actually helps you to pay that wouldn’t normally be included in your personal budget. If in case your income is been interrupted this fund be useful to pay your regular expenses. In today’s unknown economic environment, people should focus on saving as much as possible.

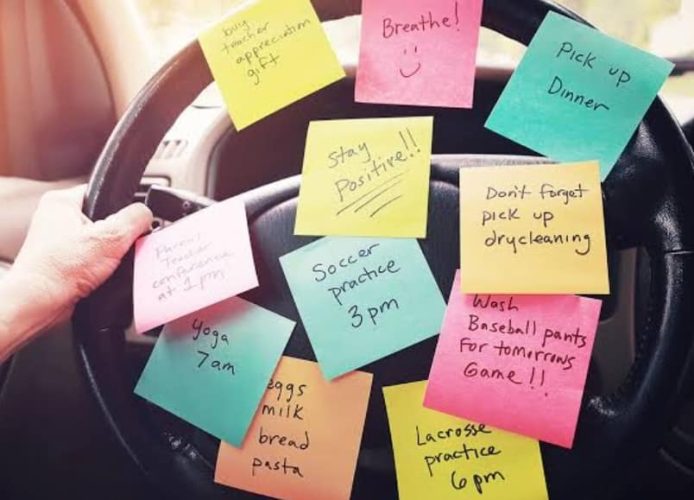

8. Prioritize your things

Prioritizing things can be a bit difficult but it is one of the important parts of maintaining everything. You can simply practice prioritization by creating to-do lists. Writing down everything you need to get done can eventually help you physically prioritize the tasks or things that are most urgent.

9. Increase your income

Everyone should take out a minute from a busy schedule and should think about how they can increase their income at the same time. It will not affect anything but can help financial standing. Always remember that you can actually turn a hobby into a business that generates some much-needed extra income.

10. Try not to multitask

Multitasking is not always good. In research, it was found that multitasking sometimes doesn’t save you time. In fact, it blocks up your workflow, it also increases your stress levels, and ends up hindering your overall functionality. Multitasking can also affect your long-term and short-term memory.

11. Stay organized

Everyone should know and understand that organization is an important time management technique and how necessary it is to be organized in life. Now here organization doesn’t mean physically keeping your space organized. This also means staying mentally organized as well. Staying mentally organized is not about arranging parallel tasks. It’s about setting goals for your day and try organizing the tasks.

12. Map out tasks the day before

Mapping out tasks the day before can make the new day more simple as you already know all things or tasks you have to complete in a whole day. This will help to improve your time management. Once you know and can tell what to do at that moment, you will feel that you’re in control of your clock. This strategy can also be helpful as your work life and your personal life will become less stressful.